How do private funds provide capital to early-stage companies?

A fund is an entity created to pool money from multiple investors—often referred to as limited partners. Each investor makes an investment in the fund by purchasing an interest in the fund entity, and the adviser uses that money to make investments on behalf of the fund. Traditional venture funds typically invest in businesses in exchange for equity and some firms specialize in particular industries or in companies at a certain stage (for example, early, mature, or later stage).

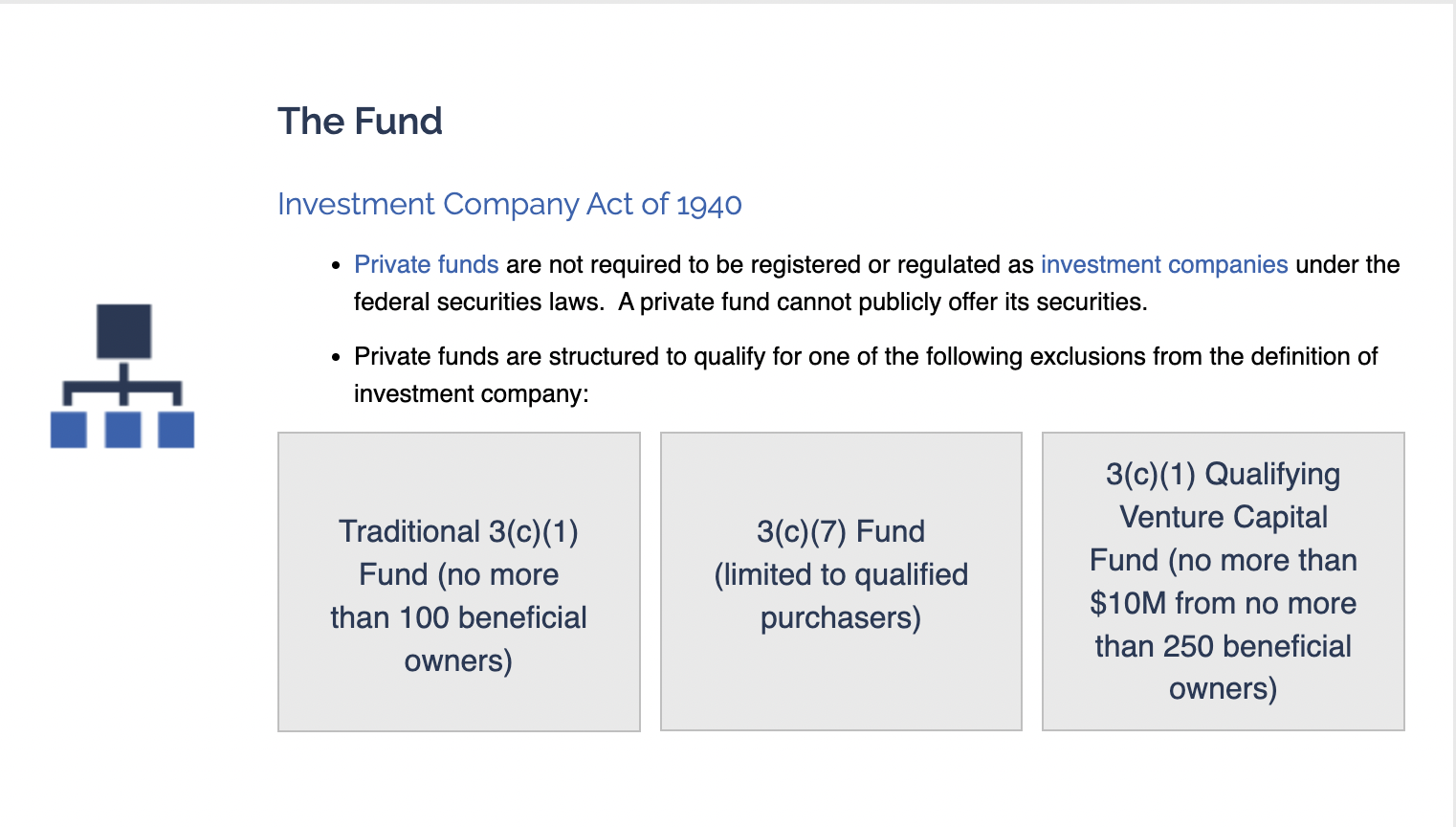

What laws apply to different aspects of a private fund’s operations?

What is an accredited investor?

To purchase certain investments, you must be an accredited investor. But what does that mean, and how do you know if you qualify?

An accredited investor is a person or entity that is allowed to participate in investments not registered with the SEC. These are typically high-net-worth individuals and companies with the means and experience to trade private, riskier investments.

According to the Securities and Exchange Commission, an individual accredited investor is anyone who:

-

Earned income of more than $200,000 (or $300,000 together with a spouse) in each of the last two years and reasonably expects to earn the same for the current year.

-

Has a net worth over $1 million, either individually or together with a spouse (excluding the value of a primary residence).

-

Is a “knowledgeable employee” of a private fund.

-

Is a financial professional who has Series 7, Series 65 or Series 82 financial securities licenses.

The rule is meant to help prove investors have the sophistication and means to invest in potentially riskier investments, as well as weather any losses.

But on June 5, 2023, the House of Representatives passed the Fair Investment Opportunities for Professional Experts Act, which aims to broaden the criteria for accredited investors. Under the bill, people determined by the SEC to have “professional knowledge through educational or professional experience,” such as investment advisors or brokers, could also qualify to be accredited investors.

The same day, House also passed the Accredited Investor Definition Review Act, which would give the SEC discretion in determining exactly which certifications, designations or credentials are needed to be considered an accredited investor. The bill mandates the SEC review the credentials every five years and make amendments when needed.

Currently, in addition to individuals, legal entities that can be considered an accredited investor include banks, investment broker-dealers, insurance companies, charitable organizations and any entity in which all equity owners are accredited investors, and trusts with assets that exceed $5 million.

How do you become an accredited investor?

There’s no certification offered to prove you’re an accredited investor. Instead, companies selling investments to accredited investors are required to take steps to verify you qualify.

That likely will mean you must release financial statements — such as W-2s, tax returns, bank and brokerage statements — showing your current net worth is more than $1 million (your primary place of residence not included) or that you had income in the past two calendar years that qualifies.

In August 2020, the U.S. Securities and Exchange Commission expanded its definition of individuals and organizations that qualify as an accredited investor.

For most retail investors, the biggest change will be allowing a “spousal equivalent,” such as a live-in significant other, to be considered when looking at total household income or savings to determine if you qualify as an accredited investor.

Why do you have to be an accredited investor?

The accredited investor exemption seeks “…to ensure that all participating investors are financially sophisticated and able to fend for themselves or sustain the risk of loss, thus rendering unnecessary the protections that come from a registered offering,” the SEC says.

The rules regarding accredited investors are governed by SEC Rule 501 under Regulation D of the Securities Act of 1933, a government response to the Great Depression.

Also known as the “truth in securities” law, this act improved financial disclosure requirements so investors are informed about the investments they are buying. It also tightened rules prohibiting fraud and misrepresentation in the sale of securities.

Examples of investments that require accredited investors:

-

Hedge fund investments. Since hedge funds can invest in more speculative investments, they only accept accredited investors.

-

Private equity investments. Most forms of private equity investing, including venture capital and angel investing require accredited investors.

-

Online real estate investment providers. Some real estate crowdfunding platforms, including Crowdstreet and EquityMultiple, are only open to accredited investors.

-

Venture capital investments and startups. Because venture capital funds do not require the same information disclosures as offerings registered with the SEC, they usually require accredited investors due to the higher risks.

What is the role of accredited investors?

For companies raising capital, the accredited investor definition largely determines who is in their pool of potential investors, and for investors whether they are eligible to invest in many early-stage companies. Many of the offering exemptions under the federal securities laws limit participation to accredited investors or contain restrictions on participation by non-accredited investors.

How can individuals qualify as accredited?

Individuals (i.e., natural persons) may qualify as accredited investors based on wealth and income thresholds, as well as other measures of financial sophistication.

How can entities qualify as accredited?

Depending upon the structure of the entity or its assets, entities may qualify as an accredited investor.

Can nonaccredited investors invest?

Yes. Any publicly traded stock, bond, mutual fund or publicly traded real estate investment trust, or REIT, is available to any adult who opens a brokerage account.

Many of these investments are also available within retirement accounts, such as 401(k)s and individual retirement accounts.

Because these investments are listed with the SEC, they meet requirements that help safeguard average investors. But remember, no investment is without risk, and you can end up losing some or all your principal investment.

This resource represents the views of the staff of the Office of the Advocate for Small Business Capital Formation. It is not a rule, regulation, or statement of the Securities and Exchange Commission (“Commission”). The Commission has neither approved nor disapproved its content. This resource, like all staff statements, has no legal force or effect: it does not alter or amend applicable law, and it creates no new or additional obligations for any person. This resource does not provide legal advice. This resource was produced and disseminated at U.S. taxpayer expense.

Have suggestions on additional educational resources? Email smallbusiness@sec.gov.